lowes tax exemption registration

To begin the document utilize the Fill Sign Online button or tick the preview image of the form. Tax-Exempt Management System TEMS Click Sign in or Register in the top right corner.

Estores Lowe S Catalog Search Reminders Office Of Business And Finance

Sign in with the business account you will be making tax exempt purchases with.

. The advanced tools of the editor will direct you through the editable PDF template. Let us know and well give you a tax exempt ID to use in our stores and online. If not already registered as tax exempt with Lowes customers will need to bring their tax exempt certificate to the local Lowes store to make a copy and there is a tax exempt form at the Customer Service desk to complete and sign.

All purchases made with a University p-card are exempt from North Carolina State sales tax. Establish your tax exempt status. If discretionary funds are used departments may opt to pay for sales tax in lieu of requesting a refund.

Provide your sales tax ID number issued by any state. You must include the AgTimber Number on the agricultural exemption certificate PDF or the timber exemption certificate PDF when buying qualifying items. Please clip your card below and use for your store tax exempt purchases.

Include the following information. What form should I get. The way to complete the Lowes application pdf form on the web.

Claiming exemption from lead-acid battery fee for. Manufacturing Partial Exemptions Check the appropriate box for the type of exemption to be claimed according to section 144054 RSMo. A Lowes Tax Exempt Registration Number has been created for use with the contract.

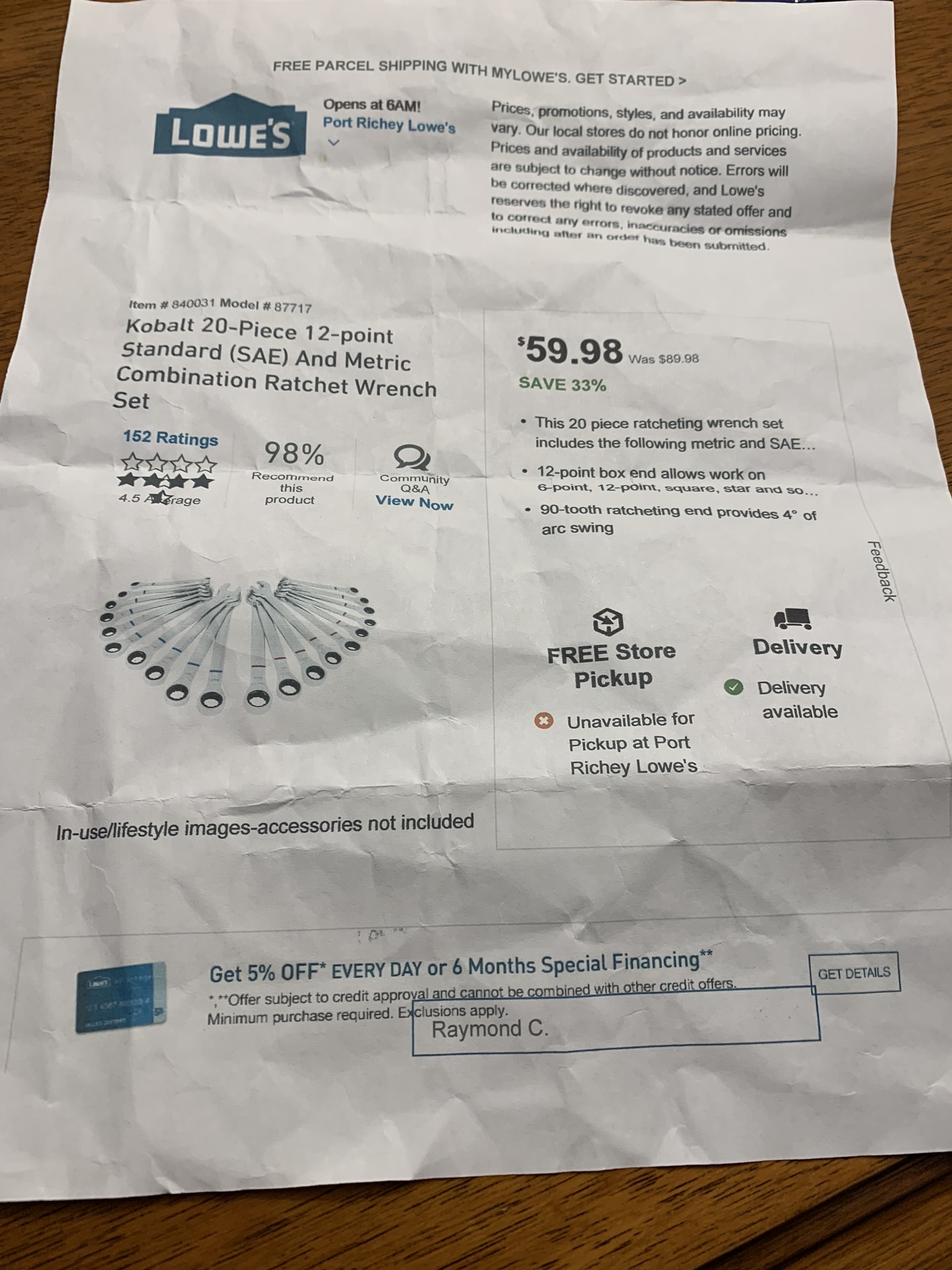

Utilize a check mark to indicate the answer. Errors will be corrected where discovered and Lowes reserves the right to revoke any stated offer and to correct. All items in this section are exempt from State Tax and Local Use Tax but are still taxable for Local Sales Tax.

The Home Depot Tax Exempt Registration. If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. All registrations are subject to review and approval based on state and local laws.

Once signed in select Your NameAccount in the top right corner. Enter your official contact and identification details. Receive free select drinks and snacks4 access to business tools and Paint Rewards2.

Trying to get sales tax exemption at Lowes. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. Select Payment Type from the drop down box 1.

Our local stores do not honor online pricing. Get a 695 credit card annual fee waived in my Ultimate Military Credit Cards Course. Select Sign In or Register in the top right corner.

Not registered in the state you are claiming the tax exemption. The Platinum Card from American Express card is annual fee waived for military. Specific items being purchased for resale 4.

To claim a tax exemption on qualifying items you must apply for an agricultural and timber registration number AgTimber Number from the Comptroller. 1 2012 a person claiming exemption from sales tax on purchases of certain items used in the production of agriculture and timber products must provide a Texas Agriculture and Timber Registration Number AgTimber Number issued by the Comptroller of Public Accounts on the exemption certificate issued to the retailer. Once signed in click on My Account in the top right corner of the search bar.

Thereof how do you do tax exempt at Lowes. The number is printed on the face of the Key Fob and has been approved by the state for use by all eligible agencies using the contract. Not required to register for sales tax and you do not have a sales tax identification number from any state.

Use your Home Depot tax exempt ID at checkout. Have your local Lowes store provide your Lowes customer ID or Lowes tax ID. Remit Vendor Number assigned by Lowes 3.

As of January 5 2021 Form 1024-A applications for recognition of exemption. As of January 31 2020 Form 1023 applications for recognition of exemption must be submitted electronically online at wwwpaygov. Start earning Lowes E-Gift Cards once annual qualifying spend reaches 25001.

Register to bid on scratch dent new condition customer returns and refurbished major kitchen and laundry appliances. Tax-Exempt Management System TEMSSelect Sign In or Register in the top right cornerOnce signed in select My Account in the top right corner of the search barSelect Organization and then select Tax ExemptionsHave your local Lowes store provide your Lowes customer ID or Lowes tax IDMore items. Tax exempt purchases must be supported with a Lowes Tax Exempt Registration Number.

Prices and availability of products and services are subject to change without notice. All items selected in this section are exempt from all salesuse tax under section 144030 RSMo. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Claiming exemption from salesuse tax for. Lowes Military Discount 2022 Active Duty Retiree Military 10 Discount. We use cookies to give you the best possible experience on our website.

Lowe automotive warehouse inc 1000 camera ave suite d saint louis mo 63126. Chances to win prizes to help level up your business. Business Name and Address 2.

Prices Promotions styles and availability may vary. Are you a tax exempt shopper. The official B2B auction marketplace for Lowes Liquidation offering brand-name appliances in bulk quantities.

If claiming exemption in MI and registration is not required in the state enter Not Required. Link to Lowes Home Improvement Home Page. Select Tax Exemptions under the Account Details section.

If you have any questions about Home Depot Tax Exemption please call The Home Depot Tax Department. MVPs Pro Rewards Program. Click Organization and then click Tax Exemptions Have your local Lowes store provide you with your Lowes Customer ID or Lowes Tax ID.

TAX EXEMPT CUSTOMERS 1. Claiming exemption from tire fee for. - Answered by a verified Tax Professional.

Resale registered battery retailer missouri battery fee id number agricultural operations 7. All commercially prepared food with the exceptions noted within University Policy 709 Food Service must be prepared by the food service company. Applying for Tax Exempt Status.

Home Depot Pro Desk Vs Lowe S Pro Desk Workiz

Sliding Patio Doors At Lowes Com Sliding Patio Doors Patio Doors Blinds

Lowes Corporate Complaints Number 2 Hissingkitty Com

Sierra Russo Assistant Store Manager Lovesac Linkedin

Lowe S Official Military Discount Policy

How To Sell A Product In Lowes Icsid Org

Lowe S Home Centers Llc Cooperative Contract How To Participate

Lowe S Class Action Says Warranty Is Pointless Top Class Actions

30m Shop Center Eyed Next To Costco Business Lancasteronline Com

Lowe S Home Centers Llc Cooperative Contract How To Participate

Lowes Corporate Complaints Number 4 Hissingkitty Com

Estores Lowe S Catalog Search Reminders Office Of Business And Finance

Home Depot Pro Desk Vs Lowe S Pro Desk Workiz

Lowe S Canada Coupons Promo Codes March 2022 Lowes Ca

Lowe S Home Centers Llc Cooperative Contract How To Participate