are raffle tickets tax deductible irs

Proceeds from this raffle benefit Special Olympics Southern California. Tax filing requirements relating to charitable deductions of donors who purchase goods at charity auctions.

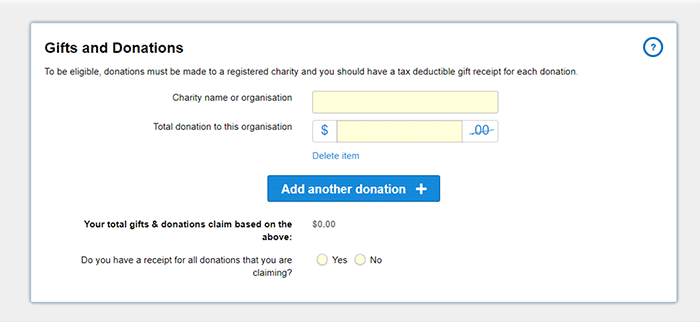

How To Claim Tax Deductible Donations On Your Tax Return

BGCMD a Colorado nonprofit corporation and tax-exempt organization under Section 501c3 of the Internal Revenue Code is conducting the Denver Dream House Raffle the Raffle to raise funds for its ongoing charitable activities and.

. Link to the Practice Lab to gain. Tickets may be purchased online in person or by phone. Employees of the Perry Technical Foundation and their immediate households are not eligible to enter.

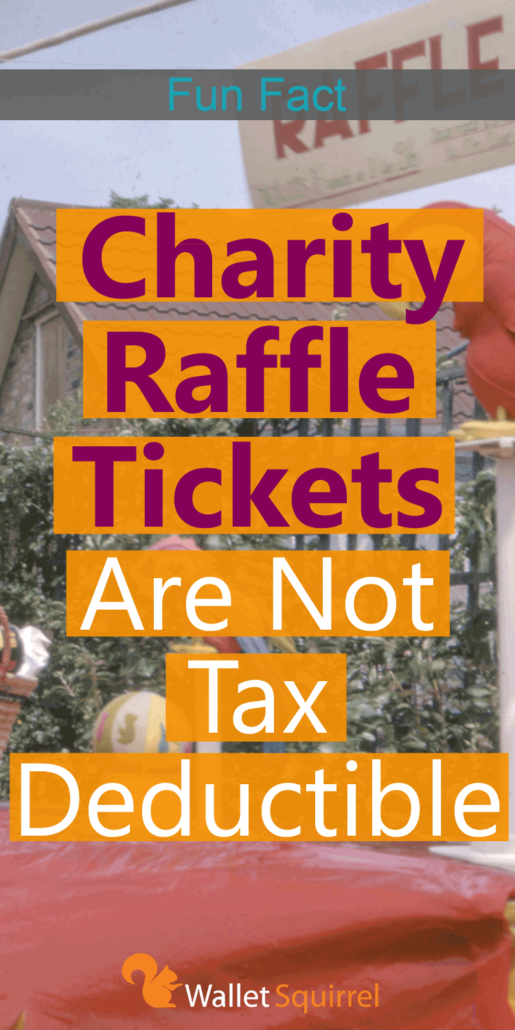

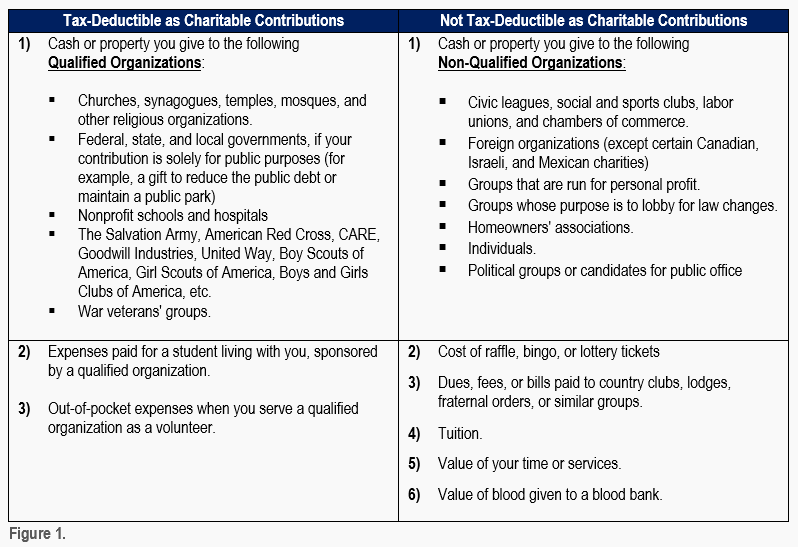

10-2011 Catalog Number 34183E Department of the Treasury Internal Revenue Service wwwirsgov Volunteer Income Tax Assistance VITA Tax Counseling for the Elderly TCE VITATCE Volunteer Resource Guide 2011 RETURNS Take your VITATCE training online at wwwirsgov keyword. Unfortunately fund-raising tickets are not deductible. The raffle will begin at 10 am on Wednesday December 15 2021 and will conclude at.

The raffle ticket price is not tax deductible as a contribution to the Foundation. In other words if a divorce was finalized in 2021 then the alimony recipient no longer pays taxes on these payments. You do not have to pay tax on alimony received under a court order or decree made after December 31 2018.

500 in travel expenses 2 Tickets to the NASCAR Hall of Fame 250 in local Food Entertainment Gift Cards. If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater than the value of the benefit you receive. See the link to the IRS sales tax deduction calculator at the bottom of the page.

Also please note the IRS does not allow money spent on raffle tickets to be tax deductible contributions. 7 Night Stay at the Earnhardt Family Lakehouse on beautiful Lake Norman NC. Winner must claim prize by April 30 2022.

The IRS considers a raffle ticket to be a contribution from which you benefit. Meet and Greet with Dale Earnhardt Jr. Holding on to all of your losing tickets can be a good idea in the event the IRS ever questions the validity of your deduction.

Schedule A - Sales Tax Deduction If the taxpayer has a large amount of nontaxable income calculate their sales tax deduction using the IRS sales tax deduction calculator. A Mighty Pack is available for purchase and includes a 6-pack of Raffle tickets and 7 100 Days of Winning Cash Calendar tickets for 500. Raffle licenses can only be granted to local religious charitable service fraternal or veterans organization or any organization to which contributions are deductible for federal income tax purposes or state income or franchise tax purposes which have been in existence for at least one 1 year immediately preceding its application for a license or that is chartered by a state or.

Boys Girls Clubs of Metro Denver Inc. The IRS suggests writing down the dates you purchase lottery tickets their cost the place where you bought them the names of other people who may be with you and the amount you win or lose on each ticket. Attending private schools and amounts paid for raffle tickets or to play bingo or other games of chance.

Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by organizations to raise money. Prices are 1 for 100 3-pack for 250 5-pack for 375. So that poker night or silent auction that created such a buzzmake sure that the buzz is not the vibration of your cell phone letting you know that your nonprofit is being cited for criminal.

Per IRS regulations as a game of chance raffle tickets are not tax deductible. The calcu-lator adds nontaxable income to AGI to give the taxpayer a larger sales tax deduction. BOYS GIRLS CLUBS OF METRO DENVER 2022 Denver Dream House Raffle Official Rules.

House includes 4 Bedrooms 3 Baths Large bonus room with Table Tennis Stand-Up Paddle Boards and In-Ground Pool. Link Learn Taxes. Special Olympics Washington a tax exempt organization under Section 501c3 of the Internal Revenue Code is conducting this raffle pursuant to SB 5723 Washington Administrative Code 230-03-152 to raise funds for ongoing charitable purposes.

The IRS explicitly prohibits deducting the cost of raffle tickets as a charitable contribution. Enhanced Raffle Rules 2022. Many nonprofits use games of chance and auctions as fundraising vehicles without realizing that legalized games of chance are regulated activities and indeed illegal in many states.

They may not be purchased from funds received via mail nor will the Foundation send tickets back to purchasers via mail. Special Olympics Southern California accepts American Express Visa MasterCard Discover check or money order payable to SOSC for payment. A Mighty Max Pack is available for purchase and includes a 10-pack of Raffle tickets and 10 100 Days of Winning Cash Calendar Tickets for 750.

Foreign Organizations Foreign organizations that meet the requirements for exemption under IRC 501c3 may establish exemption from federal income tax but in the absence of a. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for. The alimony payer pays regular incomes taxes prior to making the alimony payments meaning they are not tax deductible.

A Quick Guide To Deducting Your Donations Charity Navigator

A Quick Guide To Deducting Your Donations Charity Navigator

Charitable Donation Receipts Requirements As Supporting Documents For Tax Deductible Donations Donation Letter Donation Letter Template Donation Form

Are Charitable Donations Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

A Quick Guide To Deducting Your Donations Charity Navigator

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Free Vehicle Donation Receipt Template Sample Word Pdf Eforms

Are Raffle Tickets Tax Deductible The Finances Hub

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Charitable Deductions On Your Tax Return Cash And Gifts

Which Charitable Contributions Are Tax Deductible Infographic Turbotax Tax Tips Videos

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Tax Deductible Charities Tax Deductible Donations Irs 526 Tax Deductions Charity Donate

5 Most Overlooked Rental Property Tax Deductions Accidental Rental Rental Property Real Estate Rentals Rental Property Management

Tbt A Night In Old Havana Gala Bsaz Creates Havana Nights Party Havana Theme Party Havana Nights Theme

Understanding Tax Deductions For Charitable Donations